The world of collecting, whether it’s for fun, investment, or both, can cover pretty much anything. From the humble stamp collection right up to galleries of antiquities, there is something very human about taking joy and satisfaction from building a cache of objects related to something you're passionate about.

In some cases, these objects can be extremely valuable. In 2022, a lucky basketball fan bought a Chicago Bulls jersey worn by Michael Jordan in the 1998 NBA finals for a cool $10.1m. Jordan's sneakers also make headlines when they come up for auction too.

Back in 2021, philatelists offered eye watering bids for an incredibly rare British Guiana One-Cent Magenta stamp, which sold for $8.3m when it went under the hammer. In 2024, a copy of Action Comics No.1 - famous for being the comic book that introduced the character of Superman in 1938, sold at auction for $6m.

While these are extreme examples, your clients might have a passion for collecting without an understanding of what the latest value of their collections are and how much they should be insured for. There is a lot to consider in this area, especially when collectables are susceptible to valuation issues that can arise from market fluctuations, ownership concerns, and the prevalence of fakes.

What are your clients collecting?

Fine art, such as paintings, sculptures, and limited-edition prints by renowned artists, are often associated with significant financial worth. The art market is dynamic, with pieces frequently increasing in value due to factors such as the artist’s reputation, the rarity of the work, and demand at auction. Collectors often invest in fine art not only for its aesthetic value but also as a financial asset.

Pop-culture collectables, on the other hand, can be anything from vintage sports jerseys to original film props, or even rare collectables like toys and comics. These items are often valuable due to their cultural significance or connections to iconic events or figures. A signed football shirt from a major sporting event, for example, or a rare vintage action figure can fetch surprising amounts at auction.

Your clients may possess a mix of fine art, collectables, and memorabilia without realising their true value. As their broker, it’s important to help clients understand the potential worth of these items and the necessity of proper valuation and insurance.

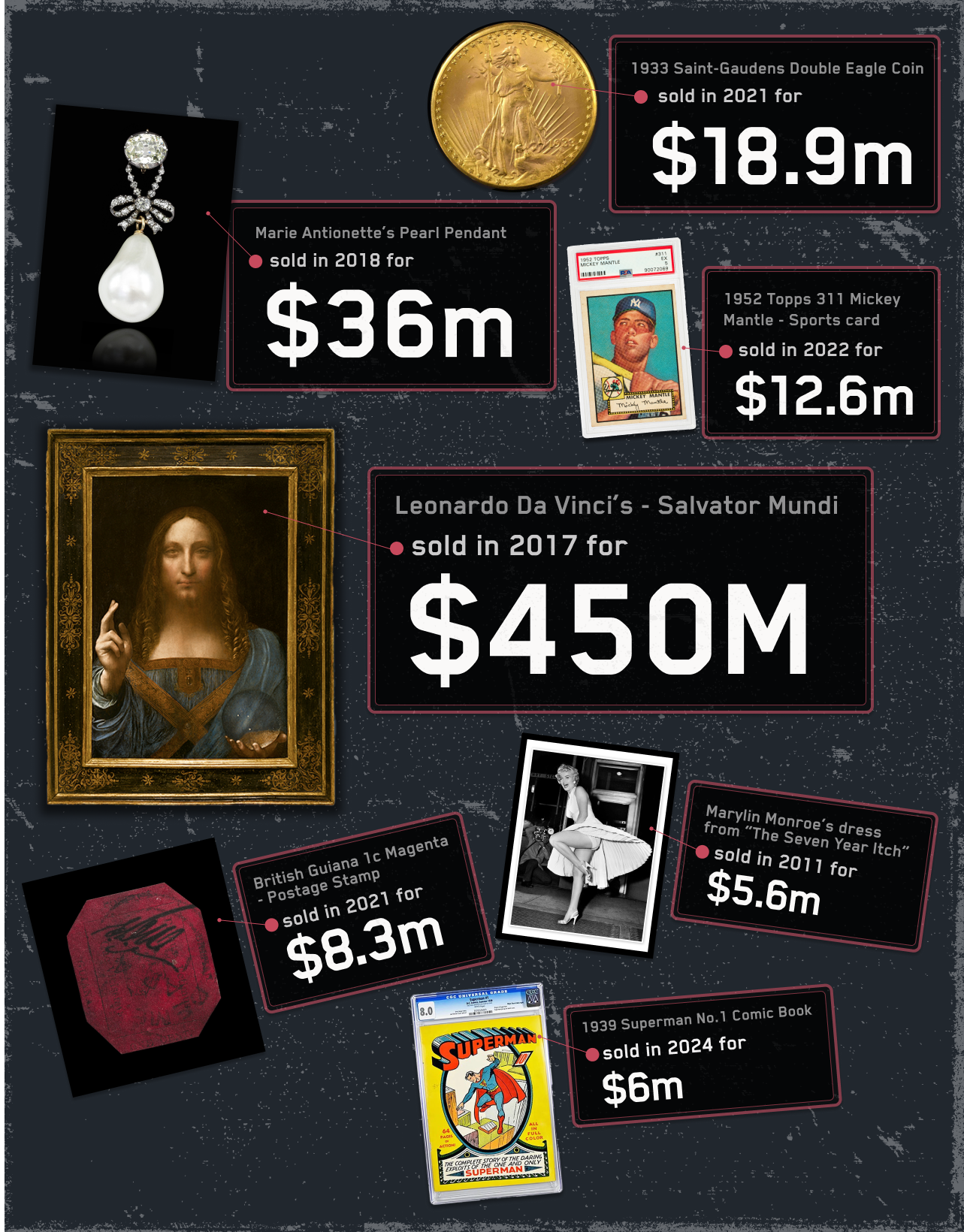

Some of the most expensive collectables sold at auction

To give a sense of scale of what’s collected by your clients, let’s take a look at some of the most valuable items that collectors have paid a considerable sum for at auction.

Sources:

https://www.withvincent.com/research/10-most-expensive-comic-books

https://www.abps.org.uk/worlds-rarest-stamp-to-be-shown-at-stampex-2023/

https://finance.yahoo.com/news/7-most-expensive-collectibles-ever-130015821.html

Why accurate valuations matter

Encouraging your clients to get their collectables and memorabilia collections professionally valued is a key part of safeguarding their financial interests. Often, clients inherit pieces, acquire items over time, or build collections with passion but they may not realise how much these items are truly worth. Without an up-to-date valuation, they could risk being underinsured, leaving them exposed to financial loss in the event of theft, damage, or loss.

Specialist valuation services, such as those provided by Doerr Dallas Valuations, offer expert assessments tailored to high-value collections. Ensuring that your clients have accurate valuations helps you to secure the appropriate level of cover, giving them peace of mind that their investments are properly protected.

The team at DOERR Dallas have shared their perspective on the criteria they look at to determine what the value might be for a specific collectable:

Provenance

Understanding the history of a piece is crucial. Where did it originate, and who owned it previously? Provenance adds authenticity and can significantly increase a piece's value.

Historic Importance/Relevance

Assessing whether the item holds significant relevance to pop culture or history. Pieces pivotal to cultural movements or influential in their respective fields often command higher prices due to their importance.

Cult/Cool Factor

Unlike other collecting arenas, the “Cool Factor” and overall cultural significance can greatly impact an item’s price. Items that are deemed trendy or are associated with influential figures or events can see inflated values based on their appeal in the collector’s market.

The Rise of Nostalgia

Nostalgia plays a pivotal role in the popularity of certain pieces, which can fluctuate over time. Newly released items may experience an immediate surge in value, but this can diminish as time passes. If a piece remains culturally significant over a decade, it may become widely regarded as collectible, enhancing its value.

Other factors that can affect collector markets

As with any other high-value market items, there are risks and challenges that come with collecting or investing in collectables that can have a direct effect on valuation;

Unpredictable Value Fluctuations

The rate at which collectable's values change can be difficult to predict. Prices can rise or fall unexpectedly, and collectors should be aware that no investment in memorabilia comes with a guaranteed profit. Many buyers often make purchases based on emotional attachment rather than logical investment decisions.

Prevalence of Fakes

Counterfeit collectable memorabilia is a common issue. Collectors must be cautious when buying items, as fake items can be difficult to distinguish from genuine ones, and these fakes can drastically impact perceived value.

Ownership Concerns

A lack of clear ownership can create complications in collectable memorabilia transactions. Possession of an item does not necessarily prove ownership. For instance, there have been disputes, like an example with Amy Winehouse’s clothing, where items made by friends were questioned by her family over whether they had the legal right to sell them.

Deceptive Presentation

Items are sometimes deliberately framed or displayed in ways that exaggerate their value. A common trick involves pairing a low-value autograph or item with unrelated memorabilia to make it appear more valuable. For example, an autograph may be displayed alongside a garment not actually worn by the celebrity in question, misleading potential buyers.

Changing Replacement Costs

The cost of replacing collectable memorabilia can fluctuate frequently. Regular reappraisal of valuable collections is essential to ensure that insurance coverage remains accurate and up to date.

The Beatles prove that even fakes can have value

Rock music collectables are a specific area that has risen in prominence since the 1980’s. Few bands hold as much weight in collector circles as The Beatles. Given the band were only together for around a decade, objects, records, and autograph books that feature the four signatures of John Lennon, Paul McCartney, George Harrison, and Ringo Starr are highly coveted. A forgotten scrap of paper bearing all four sold for £4,200 in 2019.

Getting verification on Beatle autographs is notoriously difficult. This is further complicated by the fact that due to reasons of practicality, the band’s tour manager Neil Aspinall and roadie Mal Evans became adept at forging the signatures of John, Paul, George, and Ringo to keep fans from being disappointed. Amazingly, there is even a market for these “fake” autographs, as Aspinall and Evans themselves are considered to be an important part of the wider “Beatle legend”. Here we can see an example of Neil’s handiwork that sold for £200 in 2023.

Managing risks and protecting investments

Fine art and memorabilia collections can be subject to a variety of risks, from market volatility to physical damage. Market fluctuations can affect the value of an artwork or collectable, while delicate items are at risk of being damaged by mishandling or environmental factors such as light, temperature, and humidity.

It is important clients take proactive steps in managing risks such as storage, professional restoration, conservation services and helping choose the right insurance, which can make a significant difference in the long-term preservation of collections.

We work to provide specialist cover for fine art and collectables, tailored to your clients’ specific needs as part of our home insurance. Our expertise allows us to help you protect your clients’ most valuable possessions, ensuring they are adequately covered and that any risks are mitigated.

Speak to us and safeguard your clients' collections

Our Private Client team specialises in providing tailored cover for collectors, from individual items to entire collections, helping your clients safeguard their investments. Encourage your clients to have their collections professionally valued and insured through Brit Private Client, ensuring they are never left underinsured or exposed to unnecessary risks. Whether they own a rare painting, a unique collectable or piece of memorabilia, or a combination of both, we can help you provide the right protection.

Speak to the Brit Private Client team today.