Learn about growth in technology and home automation and how this has implications for your client’s insurance.

The rapidly evolving world of technology is changing our lives in a number of ways. If we look at the different gadgets we can incorporate into our homes, there's a wealth of opportunities to make our homes “smart”. As an insurance broker, it’s important that you know how your client’s home modifications can enhance the value of their home. Our video will help you understand how the rise of smart homes and home automation could affect your client’s insurance.

Home Automation

Video Transcript

When we refer to a smart home, we mean the technology that monitors, controls, or automates any and all facets of a home.

The "Internet of Things" has triggered a technological revolution in the home, growth in this market has been exponential due to more and more installations and gadgets becoming available. Many of these help with energy-saving.

The smart home market shows no signs of slowing down, and it's estimated to be worth $300 billion in the next 5 years. Incorporating these solutions into a home isn't cheap either, entry-level smart home modifications might cost anywhere between 2%-6% of the overall value of a home, getting a fully integrated smart home solution fitted by a specialist could cost your clients thousands.

Homeowners can now make every corner of their home smart. Your clients may not be aware that the energy-saving tech and devices they install may be changing their rebuild costs.

Your clients can now choose to have a whole range of detection technologies in their homes. This makes them safer, meaning less risk, fewer claims, and potentially lower insurance premiums. This includes home security, covering everything from external cameras, alarm systems, and door locks. This will have implications for reducing the risk of break-ins at home.

Video Transcript

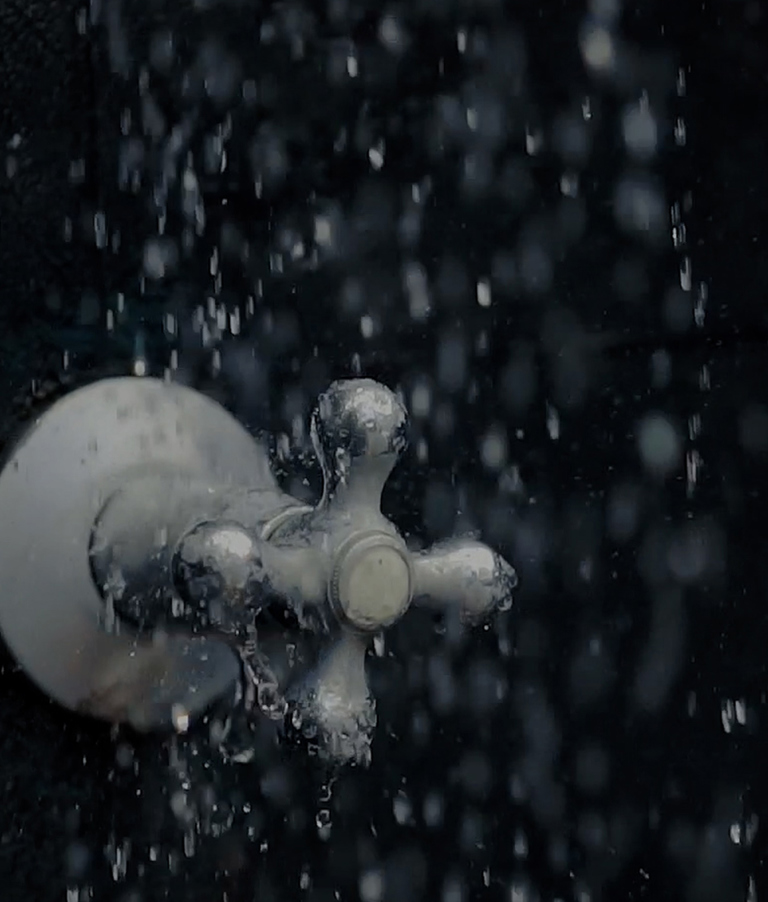

One of the most significant smart-tech innovations is leak prevention and leak detection in water pipes. This tech will help to protect your clients from a problem that costs homeowners and insurers £650m every year. Industry experts state that smart leak prevention systems can significantly reduce insurers' loss ratios, clients of insurers who recognise this will see this reflected in better pricing and terms.

While this technology has the potential to change lives, it comes with its own set of unique risks.

Cyber exposure to devices in the Internet Of Things was found to be the target of 12,000 hacking attempts in just one week, meaning potential vulnerabilities also need to be protected against. That's why all this home automation should be an important consideration when arranging your client's cover.

We know we live in an ever-changing world where the lines between science fiction and reality can be seemingly blurred at times. It's important to keep your finger on the pulse of the very latest innovations that might become commonplace in the home of tomorrow. Despite some of the risks this tech carries, the benefits mean people will continue to incorporate it into their homes.

Now and in the future, there is a lot of change going on in your clients' homes. We need to work together to ensure what matters most to them is protected throughout this technological revolution.

To ensure your client’s sum insured accurately reflects the true rebuild cost and that they stay protected against whatever lies ahead, speak to Brit Private Client.