Overview

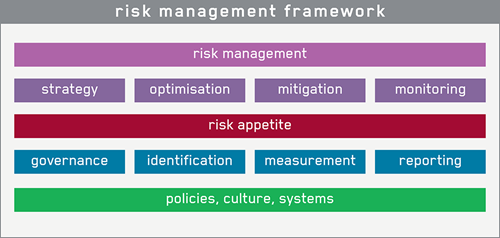

Brit delivers shareholder value by actively seeking and accepting risk within agreed limits. The Group’s risk management policy highlights the importance of managing the impact of risk on the economic value of the company. The Risk Management Framework (RMF) sets out a transparent process to identify, assess and manage risk and deploy risk appetite using an economic capital approach. This process enables Brit to protect policyholders and maximise shareholder value by ensuring the risk and capital implications of business strategy are well understood.

The company maintains a strong risk governance structure and runs effective internal controls to monitor adherence to the ERM Framework. The responsibility for risk management is clearly defined and spread throughout the organisation. The risk management team reports to the Risk Oversight Committee of the Board and supports the Committee in monitoring and reviewing the risk profile and the effectiveness of all risk management activities.

Risk Management Framework

The Group's RMF framework was designed to enable the Boards to set an appropriate risk strategy for the business and ensure that risk is managed throughout the organisation. The Framework ensures that a strong culture of risk control and management continues to be embedded at Brit. The components of the RMF framework are set out below.

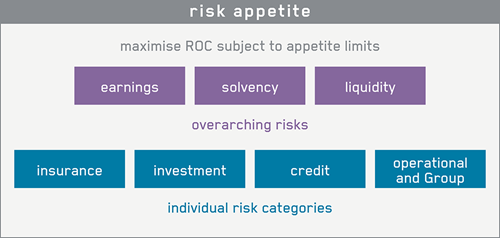

Risk appetite is set by the Board and cascaded throughout the organisation. Brit monitors the aggregation of risk across the business and has overarching limits in place to manage this. In addition to the overarching limits, the RMF framework clearly identifies the key risk categories and risk tolerances are set for each risk category by the Boards. The main components of the risk appetite are set out below.

Brit uses specialised risk management tools including sophisticated models to monitor current risk exposures relative to risk appetite. The risk governance structure ensures that this information is passed to the relevant management committee or Board.

Risk Governance Structure

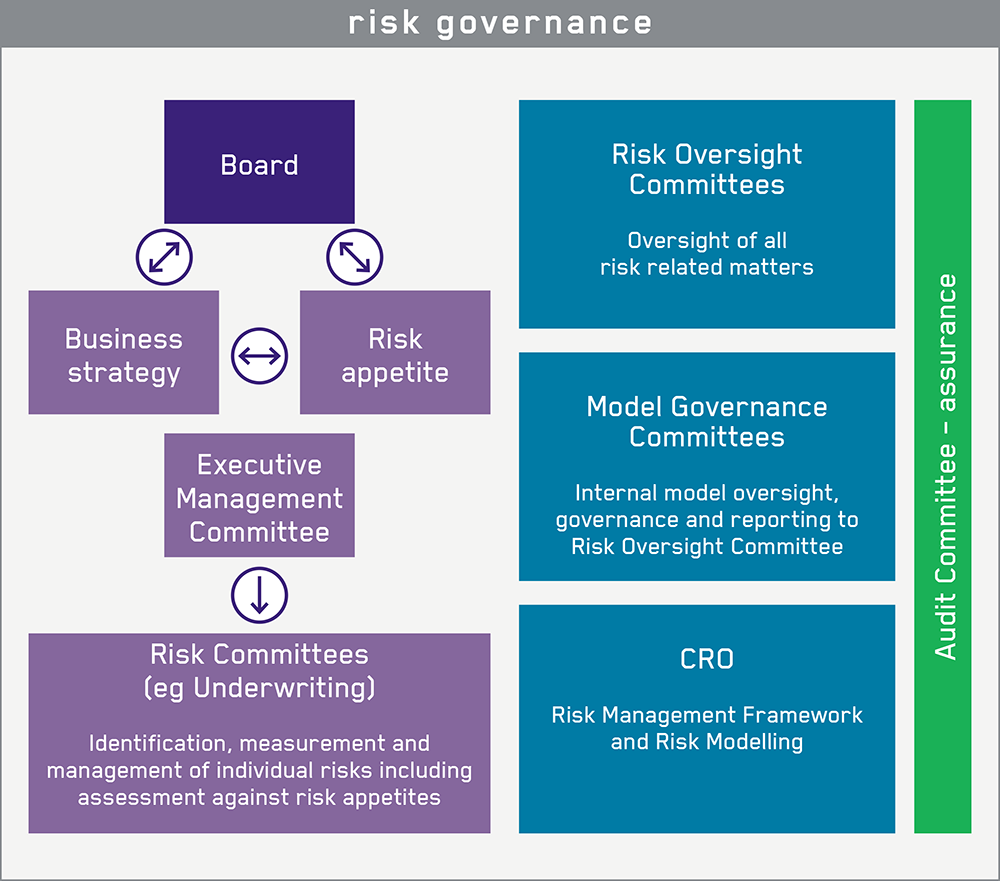

The Group and entity Boards are responsible for overseeing the risk management and internal control systems, which Management are responsible for implementing. Risk Oversight Committees and Audit Committees that consist of independent Non Executive Directors support a strong risk governance framework.

The Risk Oversight Committees monitor and review the risk profile and the effectiveness of all risk management activities and, in particular, monitor adherence to agreed risk limits. Brit’s Internal Audit function provides assurance to the Risk Oversight Committees, Audit Committees and Boards, whilst external audits are regularly used for independent assessments. An illustration of Brit’s risk governance framework is shown below.

This governance structure is applicable at the Group and entity level and represents the three lines of defence operating at Brit. Within the first line of defence, individual risk committees monitor day-to-day risk control activities. Risk management, as a second line of defence provides oversight over business processes and sets out policies and procedures. The Audit Committee, as a third line of defence provides independent assurance and monitors the effectiveness of the risk management processes.

Solvency II

Appropriate and effective risk management is a key element of the Solvency II requirements. The RMF has been developed to ensure a consistent, regulatory compliant, approach to risk management is applied throughout the organisation.

The syndicates managed by Brit Syndicates Limited (BSL) are fully compliant with Solvency II and the Lloyd’s Minimum Standards. This includes a robust Own Risk and Solvency Assessment (ORSA) process, which enables management and the Board to understand the risk and capital implications of actions during the decision making process.